Our Product

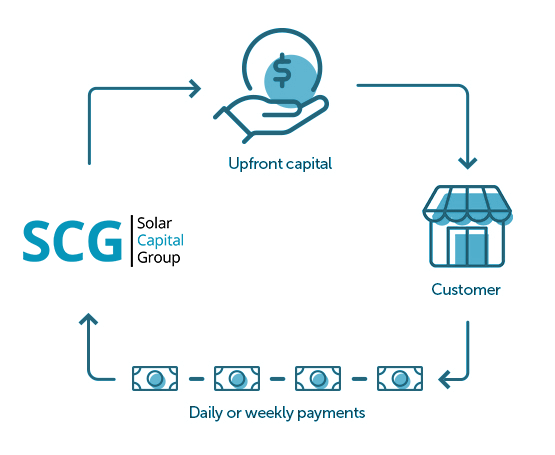

We offer revenue-based financing, which is a financing arrangement that provides upfront capital in exchange for a set amount of the business’ future revenue.

- $5,000 to $300,000 in upfront capital

- Auto-debited daily or weekly payments

- 3 – 12 months estimated payment period

Learn more about what makes our product different from traditional financing options.

Quick Eligibility Check

Do you meet these simple requirements? If so, your business may be eligible for funding! Apply now.

In business in the U.S.

for 1+ years

Make $10,000+ in

monthly revenue

Have a 500+ personal

credit score

Our Process

1

Qualify

Meet simple requirements

2

Apply

Provide basic business info

3

Get Approval

Find out within hours

4

Receive Funding

Have funds deposited often same-day

5

Renew

Consider additional funding

Qualify

Because we specialize in providing capital to underserved small businesses who may not qualify elsewhere, we keep our eligibility requirements simple and attainable. Businesses must be in business in the U.S. for at least one year, make $10,000+ in monthly revenue, and owners must have a 500+ credit score.

Apply

Our application only requires basic information – owner’s name, social security number, business name, Tax ID, and last three months’ business bank statements. Customers also provide some minimal documentation – driver’s license, voided check, signed contract, and bank verification. Rarely, other documents may be needed, such as a tax return or proof of ownership.

Get Approval

Once we receive the necessary information and documentation, we jump right into reviewing everything and conducting a full, upfront underwrite. That means when we issue an approval, our deals stick and typically do not need to be modified. Customers are usually informed of the outcome of their application within a few hours.

Receive Funding

If a customer accepts our approval, we hold a funding call with all new customers. The goal is to be very clear about the features of revenue-based financing and the terms of the contract. When the customer feels confident about their funding details and has had their questions answered, we are often able to transfer the funds into the business bank account that same day.

Renew

We make every effort to provide the funding a customer needs to help their business thrive. If a customer is up-to-date with payments and has paid about half of their balance, they may qualify for a renewal – an additional round of funding that can be used for any business purpose. Customers simply contact their dedicated Account Executive to get started.

Have specific questions about our process? Check out our FAQs to learn more.

Testimonials

What Our Customers Say

Got funded in 1 day! Steven was so helpful with the whole process. Recommend!

Outstanding company got me funded 250k with a great term. Much appreciated!

Honest company with straightforward terms, got me funded in 24 hours! Thank you Solar!

A++ company, Thank you Solar for everything!

Banks said no, but Solar said yes…Love these guys for the quick funding!

Solar helped me from the beginning to the end of the process, So easy and quick, Thank you!

Access to Technology and Real People

As soon as you’re funded, you’ll be assigned a dedicated Account Executive who is available to help you manage your funding and notify you when you’re eligible for additional financing. You’ll also have access to our self-serve customer portal, where you can see your balance and manage your account at any time.

More Than Money

We’re invested in your success beyond providing financing. Our Account Executives are a phone call away to help you navigate the funding process and help your company succeed.